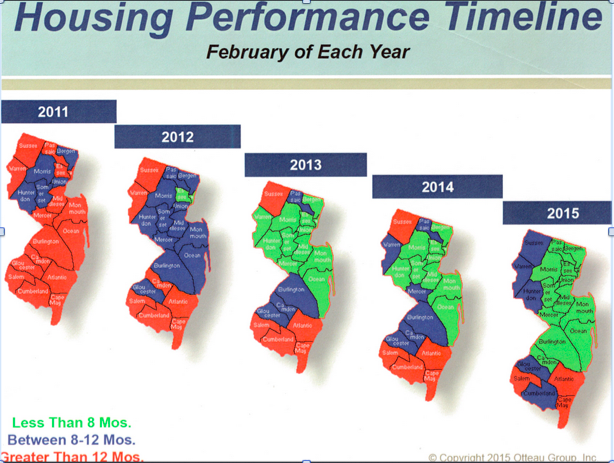

As the chart above illustrates, overall marketing time in the housing market has decreased over the past five years since the low point of the economic recession. This indicates improvement in sales activity and buyer supply as buyers have been more willing to open their wallets knowing that the worst of the recession has passed. Lower marketing times therefore indicate that sales activity is up and more buyers and sellers are beginning to fuel supply and demand. The counties in Green indicate the lowest marketing times, under 8 months, and the State of NJ turns increasingly Green as the years progress into the economic recovery phase. That being said, different property types are recovering at differing rates considering changes in supply and demand patterns. I will summarize these trends here by category:

Multi-family apartment rental buildings. This sector has seen the most dramatic improvement as tightened lending standards increased the number of renters over the past several years. Hudson County specifically has seen a dramatic build out of multi-family buildings, particularly in Jersey City, Hoboken, and Secaucus near the transit hubs accessing New York City. This trend of urbanization is expected to continue into the near future as more people elect to live closer to work in the cities and continue the generational inability to afford the larger homes, cars, and maintenance required for life in the suburbs and exurbs (student loan debt, technological advances replacing workers, globalization, etc.). However, new supply for rental apartments is already showing signs of outpacing absorption and the high demand for new construction is expected to slow.

Single Family Homes. Single Family properties are selling at a higher volume but price increases are stunted by the factors listed previously. The increased market activity is attributable to new minimum down payment mortgages, low interest rates, and Baby-Boomer property owners who see the next upward cycle far enough off that they are now willing to part with their homes at depressed prices in favor of downsizing in retirement. Generally, the recovery in the suburbs is likely to be a slow one as the rental explosion is still underway.

Office. As the workforce becomes more remote and globalized, workers are finding less need to commute to work on a daily basis and employers have less need of office space. This has driven up vacancy rates across the board. Lowered rental prices for office space in the city centers has thereby created a vacuum for companies to move their permanent office operations to the centralized areas (New York City, etc.). This has created chronic vacancy in the outlying suburban office centers. This space has no short term prospects for improved recovery unless the space can be repurposed for other uses in the absence of office tenants. This trend is expected to continue as workers evolve to depend more and more on technology to work and communicate with their offices and clients.

Retail. Retail property has exhibited an uneven recovery pattern as more people begin to shop online and the demand for storefront retail continues to decrease. Post-recession spending increases have spurred an upward trend in retail property sales overall, but not on a straight line basis. The sales tend to be effected by the weather and the time of year as people elect to do their shopping online in the winter months. Overall, the market for retail property is stable with little short term value increase on the horizon.

Warehouse/Industrial. This sector has seen improvement as a result of the aforementioned increase in online shopping. Therefore, the demand for warehousing near the urban and suburban population centers is increased as more and more goods are purchased for home delivery. This trend is expected to continue as online shopping networks continue to work toward quicker delivery times. Shipping activity in the region is also expected to increase demand for warehousing in short order as the Port of Newark dredging project is completed, thereby increasing the size of the ships and amount of cargo that can enter the harbor.

#realestate #appraisals #realestatehelm #helmstetter

RSS Feed

RSS Feed